With so much investment and new services being developed every day for mobile consumers, it seems important to know how the mobile war is progressing. Most important is to understand which technologies are winning (and therefore worth investing in) and which ones are dying.

The Players

The mobile war is being fought between a handful of global giants and a few smaller players. Most notably the main two mobile players are Google’s Android and Apple’s iOS. Among the smaller contenders are Microsoft’s Windows Phone and BlackBerry OS.

Battle Lines

The mobile war is drawn around the battle lines of operating systems. Each vendor is vying to install their flavour of mobile OS on your device which in turn gives them enormous power over the apps, technologies and revenue models that will gain ground in mobile use. Hardware vendors play a small role in this, with consumers playing an active role in this difficult selection.

Situation Report

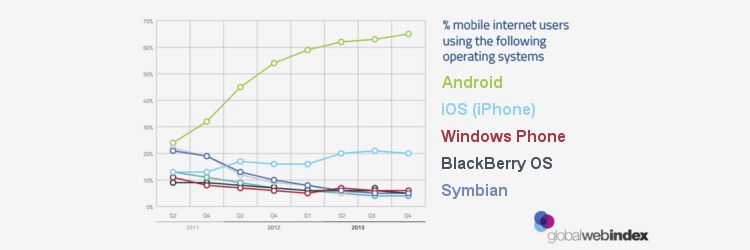

Based on market research studies (GlobalWebIndex) for the period of Q4 2013, Google Android seems to be winning, by a landslide. The report shows that Android is now running on 65% of mobile devices, up by 27% since 2012. The runner up player is Apple but this only commands 20% of the market with the rest being shared among the smaller players. The difference between the 2 giants is more marked for new mobile purchases where Android’s share rises to 82% of new phones leaving iOS with just 12%.

Among the smaller players is Microsoft (new) Windows Mobile. This platform has now been around for a while and has failed to gain any momentum in the market. Steve Ballmer retired this month without showing any significant wins for Windows Mobile and saying he regrets his lack of focus on Windows Mobile.

Blackberry is another small player in this war. Still in freefall, the once loved mobile OS is now next to zero, managing to hold on to less than 2% market share even after the launch of its brand new models.

Analysis

The world of mobile apps is now at a cross road. Starting off with distinctly separate and different platforms, each mobile OS requires investment and development resources to launch and maintain mobile apps. Businesses are now faced with the dilemma of which OS platforms to target, which in turn will determine how customers will access and interact. Whilst this choice varies from business to business, it seems that Android, with its superior adoption and availability will be the obvious choice for native apps. Apple, on the other hand, has surprised us many times before, but so far looks like its will retreat to become a niche OS.

The Microsoft platform is not dead yet. The level of investment that is now placed behind Windows Phone (by the world largest software company) cannot be underestimated. Microsoft has recently overtaken BlackBerry and may be set to gain more ground in the coming months, which could break the stalemate and bring to market some entirely new options.

Web-based mobile services, such as HTML5 mobile sites and responsive technologies still present a viable and cost effective alternative to native apps. Whilst compromising on some interface capabilities, mobile sites accessed through a mobile web browser offer the possibility of targeting a wider mobile base, without being tied to a specific mobile OS. Even more, the development and maintenance of a single application to reach all mobile customers has huge benefits for SME’s on smaller budgets.

The Financial Times became one of the first big news organisations to launch is HTML5 app that works across all mobile platforms and to pull out of iOS apps and the App Store. Users simply access FT via their browser (on whatever phone) by clicking an icon on the desktop, emulating the look and feel of a native app. FT’s app is now used by 3 million users worldwide.

Webcraft develops mobile applications and sites for businesses of all sizes.